A Qualified Retirement Plan That Provides Most Individuals

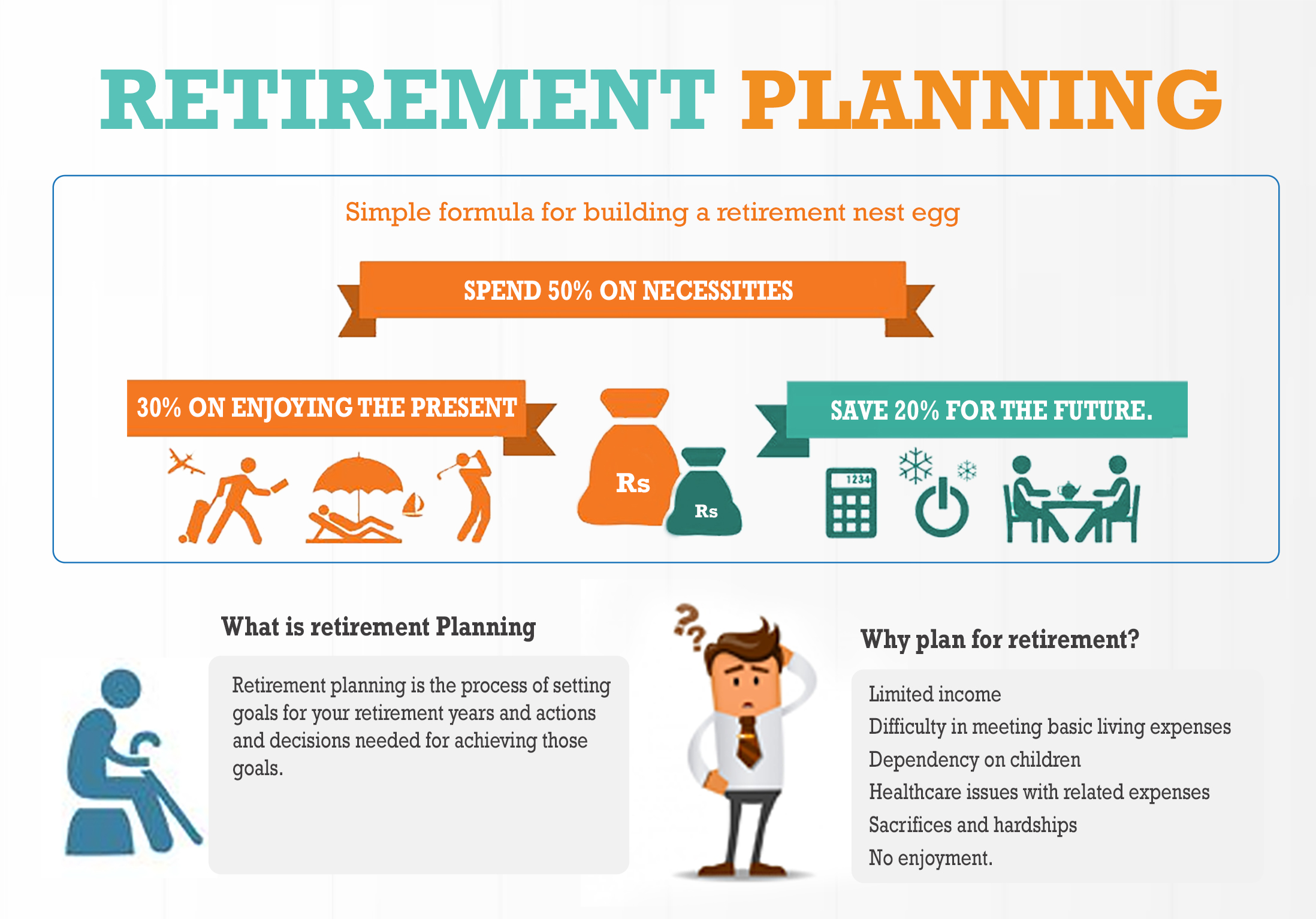

A retirement savings plan approved by the Internal Revenue Service that provides individuals with a tax benefit Non qualified retirement plans a retirement plan that is not subject to requirements regarding participation discrimination and vesting as qualified plans. What Are the Types of Qualified Retirement Plans.

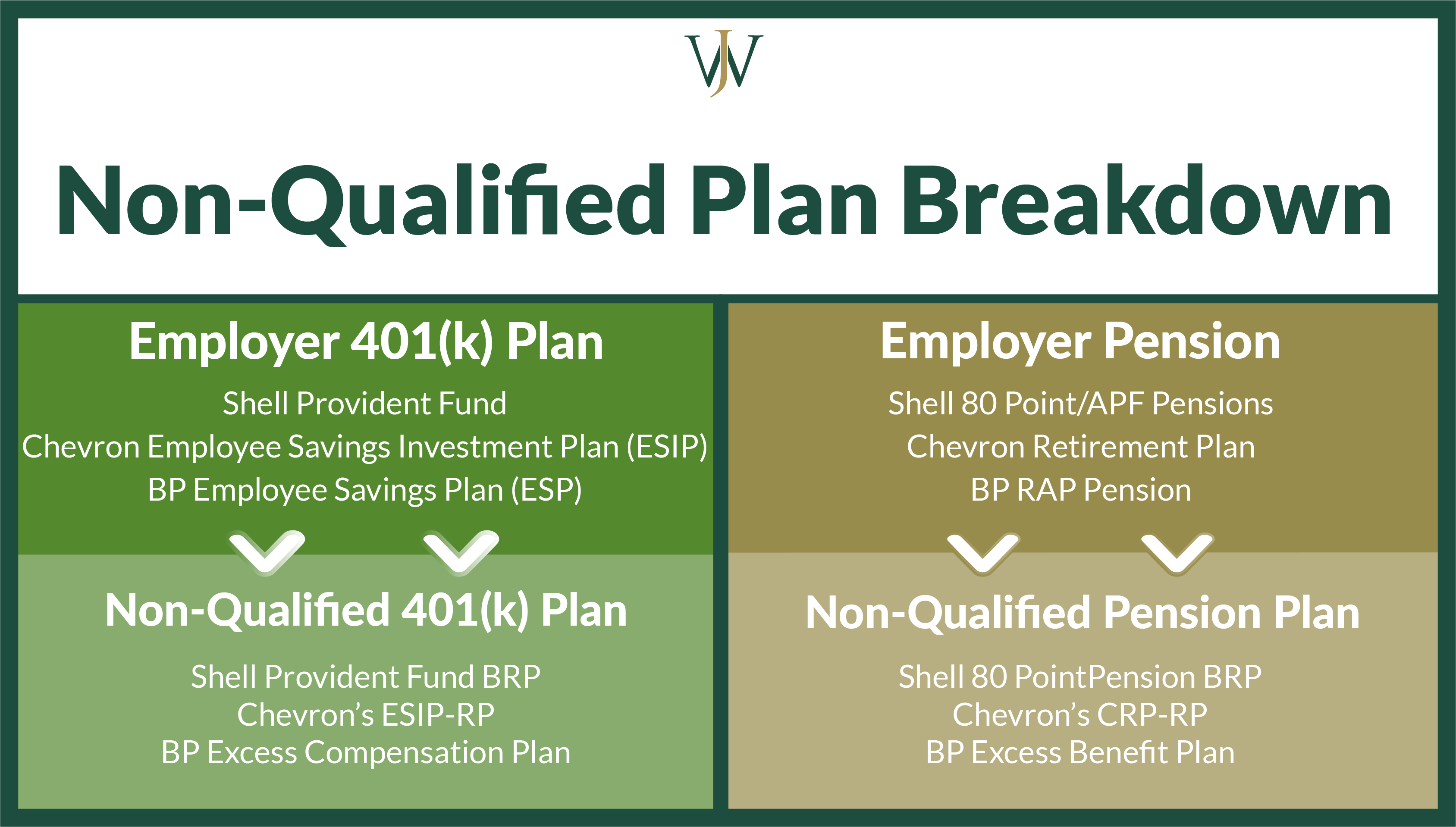

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

A qualified plan is an employer-sponsored retirement plan that qualifies for special tax treatment under Section 401a of the Internal Revenue Code.

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

. Most employer-sponsored retirement plans are qualified plans including 401k plans and pensions. Ad We specialise in dealing with the retirement planning needs of global expatriates. Qualified retirement plan A retirement savings plan approved by the Internal Revenue Service that provides individuals with a tax benefit.

To encourage Americans to save more money for their retirement the federal government has created certain types of retirement plans that offer tax benefits. Skip to main content. Find Us About.

Define Buyer Qualified Retirement Plan. A plan that provides for elective deferrals for example a 401k plan must provide that for each participant the amount of elective deferrals under the plan and all other plans contracts or arrangements of an employer maintaining the plan may not exceed the amount of the limitation in effect under Code section 402g1 Code section 401a30. Ours is a highly qualified team of British-trained and experienced specialist advisers.

A qualified retirement plan is a retirement plan that allows you to make tax-deferred contributions lowering your taxable income in the present and only requiring you to pay income tax when you withdraw money. In addition to the plan terms. A qualified retirement plan allows employers to avail tax deductions whenever they contribute to an employees account.

Your contributions may also qualify for tax deferral. Defined contribution plans allow employers and employees to contribute to individual accounts that the employer establishes under the plan. Ad We specialise in dealing with the retirement planning needs of global expatriates.

A qualified retirement plan is a type of employer-sponsored plan that provides specific retirement benefits to participating employees. Once a plan has met certain requirements specified in the Internal Revenue Code Section 401a and the Employee. A qualified retirement plan is a program implemented and maintained by an employer or individual for the primary purpose of providing retirement benefits and which meets specific rules spelled out in the Internal Revenue Code.

Direct deposit The payment of an employees net pay using electronic funds transfer. Financial Accounting Reporting FAR CPA Exam SurgentCPAReview 899 STUDY GUIDE Accounting Chapter 12 24 Terms bpalmore6. These plans may qualify for special tax benefits such as tax deferral for company contributions.

The value of the account changes over time. A qualified retirement plan that provides most individuals with a deferred federal income tax benefit individual retirement account the accounting staff position that compiles and computes payroll data then prepares journalizes and posts payroll transactions payroll clerk any amount withheld from an employees gross earnings payroll deduction. Means a pension plan as defined in Section 32 of ERISA that is maintained by Buyer or its Affiliate and intended to satisfy the tax qualification requirements of Section 401a of the Code.

There are many different types of qualified plans but they all fall into two categories. Stocks mutual funds real estate and money market funds are the types of investments sometimes held in. Individual retirement account A qualified retirement plan that provides most individuals with a deferred federal income tax benefit.

SIMPLE 401 k Plans. You dont receive a fixed benefit upon retirement. The plan must be established by the employer for the.

Roth Individual Retirement Account A qualified retirement plan that allows tax-free withdrawals from the account. Examples of qualified retirement plans include 401 k 403 b and profit-share plans. A combination of qualified and nonqualified retirement plans may be the update your retirement portfolio is lacking.

Businesses use payroll records to inform employees of their annual earnings and to prepare payroll reports for the government. Learn more about these distinct plans. Qualified retirement plans can include.

10 Types of Qualified Retirement Plans 401 k 403 b Money Purchase Plans Profit-Sharing Plans Stock Bonus Plan Employee Stock Purchase Plan ESPP Employee Stock Ownership Plan ESOP Savings Incentive Match Plan for Employees SIMPLE Simplified Employee Pension Plan SEP Individual Retirement. SIMPLE IRA Plans Savings Incentive Match Plans for Employees SEP Plans Simplified Employee Pension SARSEP Plans Salary Reduction Simplified Employee Pension Payroll Deduction IRAs. 401 k plans 403 b plans Savings Incentive Match Plan for Employees SIMPLE IRAs Simplified Employee Pension SEP.

Commission A method of paying an employee based on the amount of sales the employee generates. For an employer-sponsored qualified retirement plan these rules include. For individuals with incomes under 55000 retirement savings contribution credit the tax laws provides up to a 2000 nonrefundable savers credit to encourage contributions to certain types of retirement plans such as 401ks and Profit Sharing Plans.

A defined benefit plan eg a traditional pension plan is generally funded solely by employer contributions and provides you with a. Common examples of qualified retirement plans include but are not limited to. A qualified plan can be either a defined benefit or a defined contribution plan.

Ours is a highly qualified team of British-trained and experienced specialist advisers. 401 k A qualified retirement plan sponsored by an employer YOU MIGHT ALSO LIKE. Individual Retirement Arrangements IRAs Roth IRAs.

A qualified retirement plan is an employers plan to benefit employees that meets specific Internal Revenue Code requirements. The amount of the credit is based upon the total contributions to qualified retirement plans plus elective deferrals.

Comments

Post a Comment